You can search for the name of the app you want to try, and then download it to your phone. To get started, you'll need a smartphone that has access to either the iOS App Store or the Google Play store.

The apps listed here are all regulated by the Financial Conduct Authority (FCA), and either appear on the list of approved providers on, or access open banking via a listed firm. We've listed just a few that can help with your budgeting and savings goals. There are some 231 third-party providers currently listed by the Open Banking Implementation Entity (OBIE), which is the body set up by the Competition and Markets Authority (CMA) to set standards and guidelines for open banking. Watch our short video below to find out which budgeting apps could help you save money:

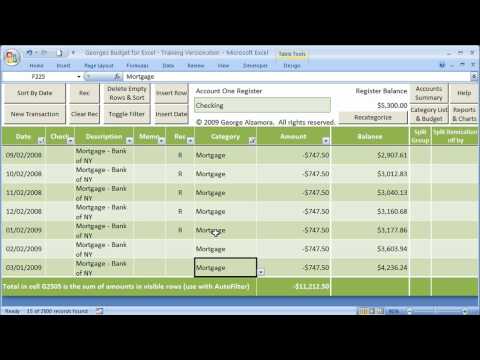

#Free simple personal budget software how to

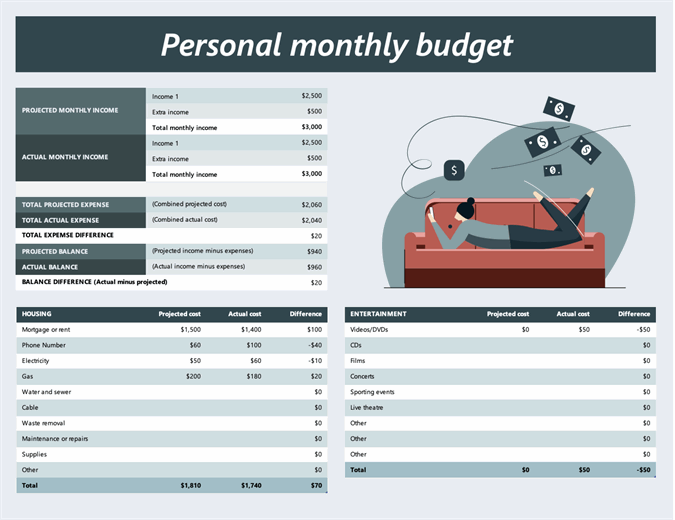

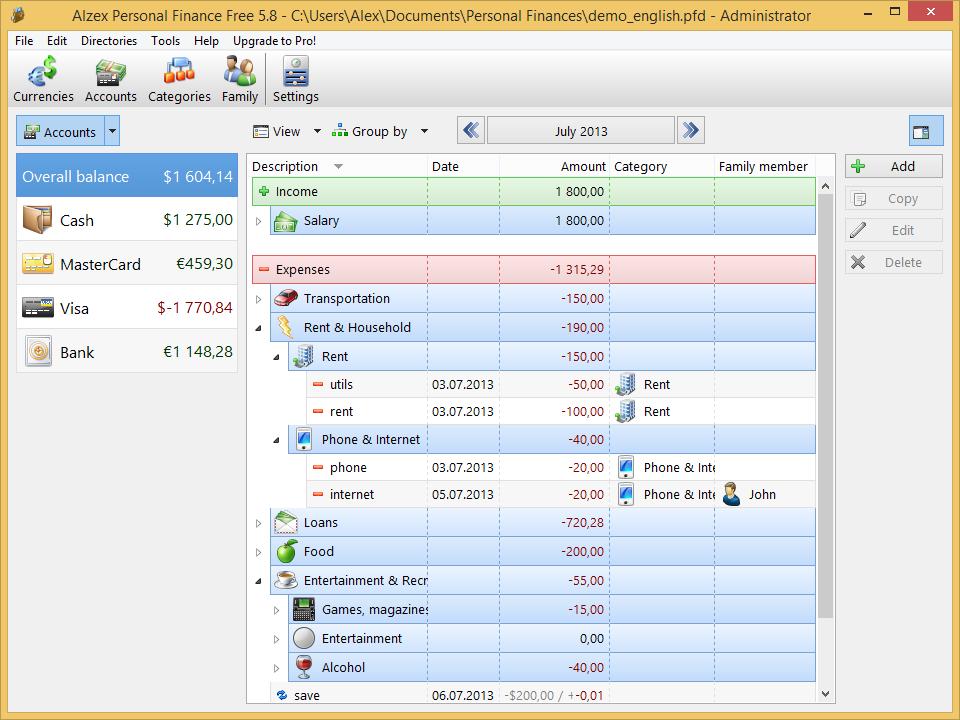

However, when we asked those who were interested in using finance apps, more than half of the respondents said they'd like to have an overview of all of their accounts, and around four in 10 said they'd like help with budgeting.įind out more: how to plan an effective budget Video: budgeting apps to help you save While more than three million people already use open banking, just one in 10 Which? members use a finance app that's not provided by their bank, according to a survey we carried out in February 2021. From getting an overview of all your accounts in one place, to developing algorithms to squirrel away extra savings without impacting your normal spending habits. Third parties that access your data can use it in a wide range of ways to help you manage your money more effectively.

These banks can now share your data with third parties safely, by plugging into feeds called Application Programming Interfaces or APIs - but, crucially, only with your permission.įind out more: open banking explained How can open banking help you budget? The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.Open banking is an initiative first launched in January 2018 to encourage innovation in financial services.Īs part of this, the Competition and Markets Authority (CMA) ordered the nine biggest current account providers (Allied Irish Bank, Bank of Ireland, Barclays, Danske, HSBC, Lloyds Banking Group, Nationwide, RBS Group, Santander) to unlock customer data. There are no guarantees that working with an adviser will yield positive returns. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). All investing involves risk, including loss of principal. This is not an offer to buy or sell any security or interest. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Securities and Exchange Commission as an investment adviser. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S.

0 kommentar(er)

0 kommentar(er)